Buying & selling a home

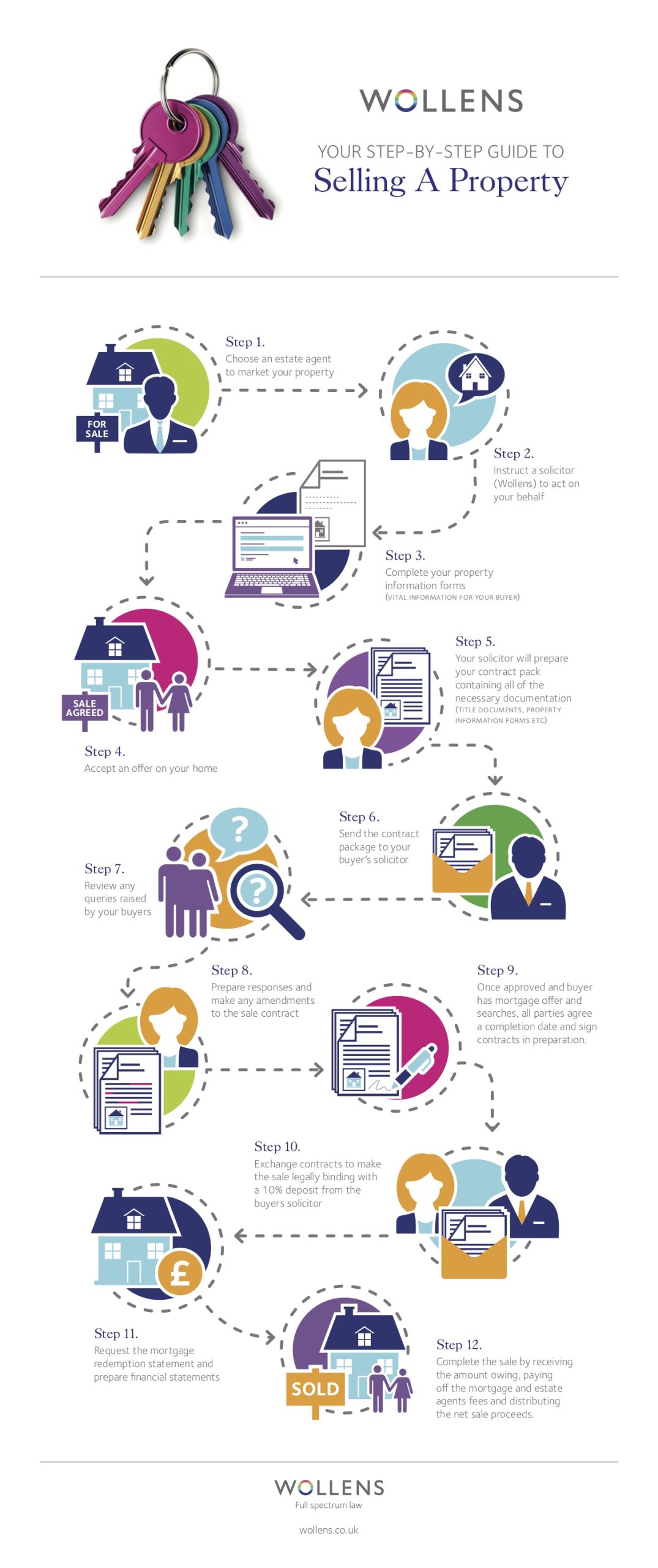

It’s often said that moving home is more stressful than bankruptcy or divorce. Whilst we don’t offer an oven cleaning or removal service, we do pride ourselves on taking away any unnecessary stress in the conveyancing process.

It goes without saying that we are property experts and have a large team of experienced lawyers across Devon who specialise in residential conveyancing. We undertake hundreds of domestic conveyancing transactions each year.

We accept that dealing with the legal aspect of your move probably isn’t top of your list of priorities. We are committed to explaining the process in an easy to understand manner and provide regular updates at each key stage of the transaction. We take a proactive approach to all transactions but still ensure your interests are protected as a priority.

As you would expect, we hold the Law Society’s Conveyancing Quality Scheme accreditation, which recognises the high standard of our conveyancing service.

We are proud of that accreditation, but prefer to allow our service to speak for itself and back that up.

We publish client feedback at https://www.reviewsolicitors.co.uk/write-review?branch=10879 and offer a 15% discount on our legal fee if you are not satisfied with the service you receive.

Please Note :

From 6 April 2020, where CGT is due on the disposal of UK residential property by a UK resident individual or trustees, a new standalone online return will need to be filed, together with payment on account of CGT, within 30 days of the date of completion of the transaction. https://www.gov.uk/government/news/get-ready-for-changes-to-capital-gains-tax-payment-for-uk-property-sales No return is needed where no CGT liability arises, e.g. gain covered by main residence relief, sold at a loss, gain(s) fall within annual CGT exemption.

For the avoidance of any doubt, HMRC have confirmed that the new reporting and payment regime applies only to taxable gains accruing on disposals of UK residential property made on or after 6 April 2020 (in the tax year 2020/21). This means that where contracts are exchanged under an unconditional contract in the tax year 2019/20 (6 April 2019 to 5 April 2020) but completion takes place on or after 6 April 2020 the 30 days filing requirement does not apply.

Contact Us

North, South, East or West. Wherever you are, we’ve got you covered. Contact us today for an informal chat, without obligation. We look forward to hearing from you.