Making a will

Astonishingly, more than half (58%) of UK adults do not currently have a will (source: National Will Register.) If you die intestate, or without making a will in the UK, you will not be able to benefit a charity or friends on your death – the law instead decides who inherits your estate.

We understand what a sensitive issue making a will can be. We will allocate a highly experienced will writing lawyer to take you through the whole process, giving you reassurance that your affairs will be taken care of properly after your death.

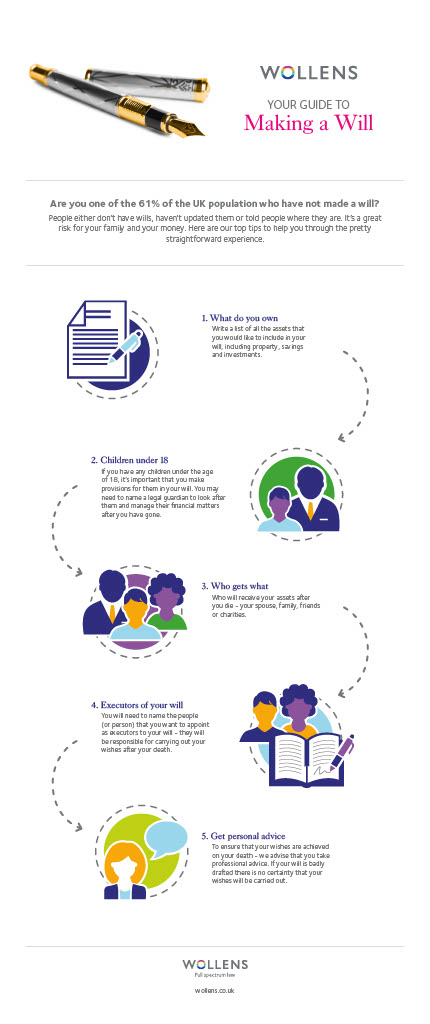

When you make or update your will it is important to take into consideration:

- Choosing the executors or trustees of your will.

- Appointing a guardian for younger children.

- Providing for those who are closest to you.

- How best to provide for those you love when you have children from a previous relationship

- Inheritance and other tax matters.

- Stating wishes for your funeral.

At the same time, as your family circumstances change, for example if relatives die, if you marry or divorce, grandchildren arrive, or grown-up children’s marriages do not work out, you should review your will. Our experienced lawyers will guide you through the process of writing a will.

Wills & Inheritance Tax Services

At Wollens, we understand that when it comes to choosing a solicitor, many people might think all law firms are pretty much the same. We believe we’re the best choice for you. Not just for advice on individual matters, but also as a long-term partner for all your legal affairs. Our team of specialists provide the full spectrum of legal services and

specialist expertise across all private matters.

We have nearly 160 of the brightest minds ready to advise you on everything from Agriculture to Acquisitions and Wayleaves to Wills (and just about everything in between). We have offices spread across 3 locations in Devon which means we are able to offer a comprehensive service with great local connections.

Our will packages

Your will is one of the most important documents you will ever sign, and we believe that it should receive the care and attention it deserves. We are pleased to be able to offer you a number of will packages, we offer a bespoke service and also a range of fixed fee options. We have priced these to give you budgetary control and certainty over pricing, whilst meeting your wishes.

Bespoke Wills Service

Our Bespoke Will service option allows you to take as much time as you need to discuss with us your Will requirements, or allows you to bolt onto our packaged

services, to produce a Will which exactly meets your requirements. It includes all the advice you will nee

What next?

Order your free wills and inheritance tax services brochure here.

Contact Us

North, South, East or West. Wherever you are, we’ve got you covered. Contact us today for an informal chat, without obligation. We look forward to hearing from you.

South Devon

01803 213251

Exeter

01392 274006

North Devon

01271 342268

View our guide to Making a Will

Wills, probate & private client news

Wollens Strengthens Community Ties with Five New Rotary Members

Wollens Strengthens Community Ties with Five New Rotary Members

How to help your executor – The First Few Stages of Estate Administration

Leaving a valid will where you have appointed an executor is the best way to ensure that your wishes and your estate is dealt with as you would want after you have died.

Kieran Wins Gold at ITF European Championships

Wollens Trainee Solicitor Kieran McDermott Wins Gold at ITF European Championships

Probate: dealing with a rental property with a tenant

Are you an executor facing the complexities of managing a rental property with a tenant in it as part of a deceased estate? Read our latest article by Liz Crawford who offers some very useful guidance on this subject.

Family Law Executive Cate appointed as Mayor of Teignmouth

Cate represent parents in pre-proceedings (PLO) with the local authority and within complex care proceedings through the Family Court as well as advising grandparents who seek to care for their grandchildren. Outside of her work at Wollens Cate is busy being elected as Mayor/Chair of Teignmouth Town Council on the 14th May 2024.

Succession and tax planning for high-net-worth families

‘Whether you have built up a portfolio of assets through business activities, savings and investments, or you have inherited a significant wealth, it is important to plan efficiently in order to minimise tax implications,’ says Jon Dickson a Partner in the wills and...

Powers of Attorney vs Deputyship

Most people are keen to make a will to ensure that their estate is dealt with in line with their wishes once they are gone, however, there is a common theme of ignoring that same estate within the lifetime

Succession and tax planning for high-net-worth families

Our wills and probate solicitors can provide bespoke advice for your high-net-worth estate and your individual family circumstances.

Providing for a pet in your will

Our wills and probate solicitors can assist in ensuring that your beloved pets are provided for after your death

Keeping legacies in the family and out of court

With disputes rising as the validity of more wills are being challenged, it is important to review and update to assure inheritance plans.