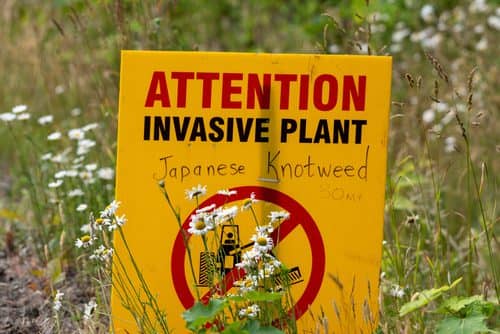

When buying or selling a house, there are various checks that need to be undertaken. These include structural surveys, checks on utilities and examination of the legal title for rights and covenants. A more abstract and unusual part of a property transaction relates to Japanese knotweed. Trainee Solicitor Katie Masefield looks at what you need to know.

What is Japanese Knotweed?

Japanese knotweed is a fast growing plant that can grow up to 10cm per day. The rhizomes (roots) can expand up to 7m underground and cause problems by interfering with gardens, patios, paths, driveways, walls, outbuildings, conservatories and drainage systems.

Completing the Property Information Form

When selling a property, one of the first things the Seller is required to do is complete the Property Information Form. This is a legal form that provides the Buyer with important information about the property. At Section 7.8 of the Property Information Form, the Seller is required to confirm whether the property is affected by Japanese knotweed. The Seller must answer ‘yes’, ‘no’, or ‘not known’. Whilst this might seem like a simple question, it is crucial to understand what each answer means.

If the Seller answers ‘yes’, they then need to confirm whether there is a management and treatment plan in place. If there is, the Seller is required to provide a copy of the plan to the Buyer along with any insurance cover linked to the plan.

The Law Society Guidance states that if the Seller answers ‘no’, they ‘must be certain that no rhizome (root) is present in the ground of the property, or within 3 meters of the property boundary even if there are no visible signs above ground’.

The Law Society Guidance states that if the Seller is unsure whether Japanese knotweed exists above or below ground, or whether it has been previously managed on the property, the Seller should choose ‘not known’.

The Implications of Japanese Knotweed for Buyers and Sellers

If the Seller answers ‘yes’ on the Property Information Form, this could affect the prospective Buyer’s ability to obtain a mortgage because lenders can be cautious when it comes to properties affected by Japanese knotweed. However, the presence of an infestation does not make it impossible to obtain a mortgage and often lenders will agree to lend if certain conditions are met.

The RICS Guidance Note on Japanese Knotweed and Residential Property (1st edition, January 2022) came into effect on 23rd March 2022. The Guidance Note provides a new Management Category assessment framework allowing Japanese knotweed to be categorised by valuers and surveyors.

In relation to obtaining a mortgage, the Guidance Note states the following:-

- Management Category A = visible material damage has been caused by Japanese knotweed

- Most lenders will require an inspection to be carried out by a remediation specialist, followed by the completion of recommended works, and an insurance backed guarantee.

- Management Category B = Japanese knotweed is likely to prevent use of or restrict access to amenity space

- Most lenders will require an inspection to be carried out by a remediation specialist, followed by the completion of recommended works, and an insurance backed guarantee.

- Management Category C = Japanese knotweed is not causing damage to significant structures within a site and not likely to prevent use of or restrict access to amenity space

- It is unlikely that lenders will require borrowers to carry out remediation work.

- Management Category D = Japanese knotweed is visible on adjoining land within 3m of the property boundary

- This should be reported to the lender, but remediation work on land beyond the subject site is not within the control of the property owner.

The presence of Japanese knotweed can also affect the value of a property. According to the 2022 RICS Guidance Note:-

- When visible damage has been caused by Japanese knotweed, the value of the property is likely to be affected.

- When Japanese knotweed is likely to prevent use of or restrict access to amenity space, the value of the property may be affected.

- When Japanese knotweed is not causing damage to significant structures within a site and not likely to prevent use of or restrict access to amenity space, the impact on the value of the property is likely to reflect the cost of remediation.

- When Japanese knotweed is visible on adjoining land within 3m of the property boundary, there is likely to be limited impact on the value of the property unless the knotweed is severe.

If the Seller answers ‘no’ on the Property Information Form, but Japanese knotweed is later discovered in the grounds of the property, or within 3 meters of the property boundary, the Buyer could be entitled to compensation from the Seller.

If the Seller answers ‘not known’ on the Property Information Form, they could pass the liability in relation to Japanese knotweed to the Buyer. If Japanese knotweed is discovered by the Buyer following completion, the Buyer would be responsible for remediation costs.

If a prospective Buyer has concerns, they could take out a knotweed indemnity insurance policy which could provide cover for remediation costs should it be discovered post completion that Japanese knotweed exists.

Furthermore, the 2022 RICS Guidance Note suggests that if Japanese knotweed is clearly visible during an inspection, it is reasonable to expect the valuer or surveyor to identify it and inform the prospective Buyer. However, it is important to note that valuations and pre-purchase surveys are not equivalent to inspections by remediation specialists.

In summary, whether you are buying or selling a property, it is important to be on the lookout for Japanese knotweed and stay alert to the risks associated with it.

For further information, Buyers and Sellers can refer to The Law Society Property Information Form (TA6) Explanatory Notes for Sellers and Buyers and the RICS Guidance note on Japanese Knotweed and Residential Property (1st edition, January 2022).

For further information, please contact Katie Masefield Trainee Solicitor in the residential property team on 01803 396602 or email [email protected]