Making a will

Astonishingly, more than half (58%) of UK adults do not currently have a will (source: National Will Register.) If you die intestate, or without making a will in the UK, you will not be able to benefit a charity or friends on your death – the law instead decides who inherits your estate.

We understand what a sensitive issue making a will can be. We will allocate a highly experienced will writing lawyer to take you through the whole process, giving you reassurance that your affairs will be taken care of properly after your death.

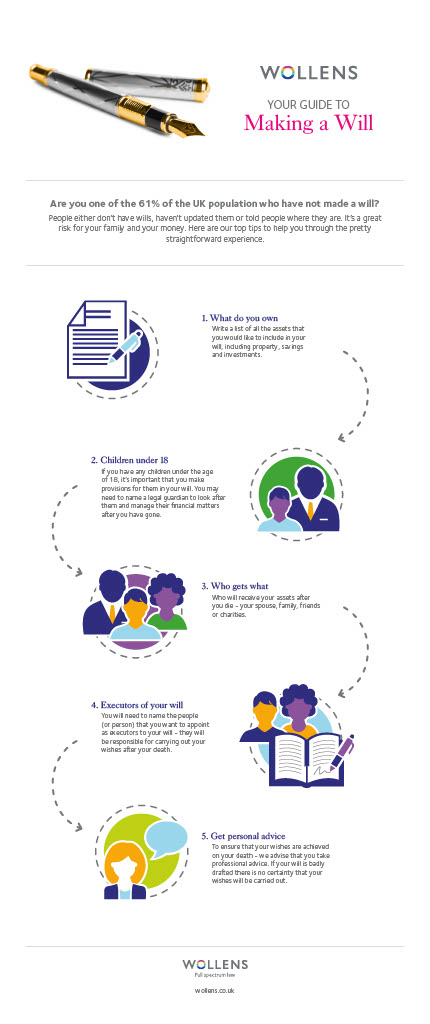

When you make or update your will it is important to take into consideration:

- Choosing the executors or trustees of your will.

- Appointing a guardian for younger children.

- Providing for those who are closest to you.

- How best to provide for those you love when you have children from a previous relationship

- Inheritance and other tax matters.

- Stating wishes for your funeral.

At the same time, as your family circumstances change, for example if relatives die, if you marry or divorce, grandchildren arrive, or grown-up children’s marriages do not work out, you should review your will. Our experienced lawyers will guide you through the process of writing a will.

Wills & Inheritance Tax Services

At Wollens, we understand that when it comes to choosing a solicitor, many people might think all law firms are pretty much the same. We believe we’re the best choice for you. Not just for advice on individual matters, but also as a long-term partner for all your legal affairs. Our team of specialists provide the full spectrum of legal services and

specialist expertise across all private matters.

We have nearly 160 of the brightest minds ready to advise you on everything from Agriculture to Acquisitions and Wayleaves to Wills (and just about everything in between). We have offices spread across 3 locations in Devon which means we are able to offer a comprehensive service with great local connections.

Our will packages

Your will is one of the most important documents you will ever sign, and we believe that it should receive the care and attention it deserves. We are pleased to be able to offer you a number of will packages, we offer a bespoke service and also a range of fixed fee options. We have priced these to give you budgetary control and certainty over pricing, whilst meeting your wishes.

Bespoke Wills Service

Our Bespoke Will service option allows you to take as much time as you need to discuss with us your Will requirements, or allows you to bolt onto our packaged

services, to produce a Will which exactly meets your requirements. It includes all the advice you will nee

What next?

Order your free wills and inheritance tax services brochure here.

Contact Us

North, South, East or West. Wherever you are, we’ve got you covered. Contact us today for an informal chat, without obligation. We look forward to hearing from you.

South Devon

01803 213251

Exeter

01392 274006

North Devon

01271 342268

View our guide to Making a Will

Wills, probate & private client news

When does a power of attorney take effect?

If you have been asked to act as an attorney for someone you may wonder when it will come into effect, especially if the power of attorney was made some time ago when your friend or relative was in good health. ‘There was an important change in 2007, and so the way...

Wollens Earns Accreditation as a Great Place to Work-Certified™ Company!

We are delighted to share that Wollens solicitors has been officially accredited as a Great Place to Work-Certified™ organisation. Great Place to Work® is the global authority on workplace culture. Since 1992, they have surveyed over 100 million employees around the...

Iain Douglas celebrates 40 years at Wollens !

If you are going through a divorce, you may have heard the term ‘clean break order’. We take a look at what this is and why it is important to secure a financial order when you end your marriage.

Avoiding common delays in obtaining probate

Probate is a term which is loosely used to cover the administration of an estate, and it has a reputation for being a lengthy process. The administration includes a number of key stages, including obtaining the grant of probate, paying out to beneficiaries, and...

Brave souls at Mission:Unbreakable 2022 !

A team of brave souls took part in Mission:Unbreakable at the weekend. The event supports North Devon Hospice and Wollens are delighted to be the headline sponsor for this event which is one of the biggest fund raising initiatives that the Hospice undertake....

Wollens celebrate inclusion within Legal 500 rankings!

Wollens is delighted to secure a place in the prestigious Legal 500 directory 2023 edition. The Legal 500 is the leading guide to law firms and solicitors in the UK. The rankings reflect the result of months of extensive analysis by the research team, who conduct...

Passing on royalties after you die

Royalty payments often require more careful consideration than a lot of other estate assets and should be dealt with by a professionally drafted will.

Legal steps to consider when diagnosed with a life-limiting illness

On top of the heartbreak and worry that a diagnosis of a life-limiting illness can cause, there will be a raft of concerns and uncertainties about your care and financial affairs, and it can be difficult to know exactly how to prepare from a legal standpoint. ‘There...

Trust Registration Service

What is the Trust Registration Service?

Reporting an estate’s value for inheritance tax

Acting as an executor means that you are responsible for reporting the value of the estate and declaring any inheritance tax due, so it is important to make sure you follow correct procedures. ‘Since January 2022, new rules apply in respect of reporting inheritance...